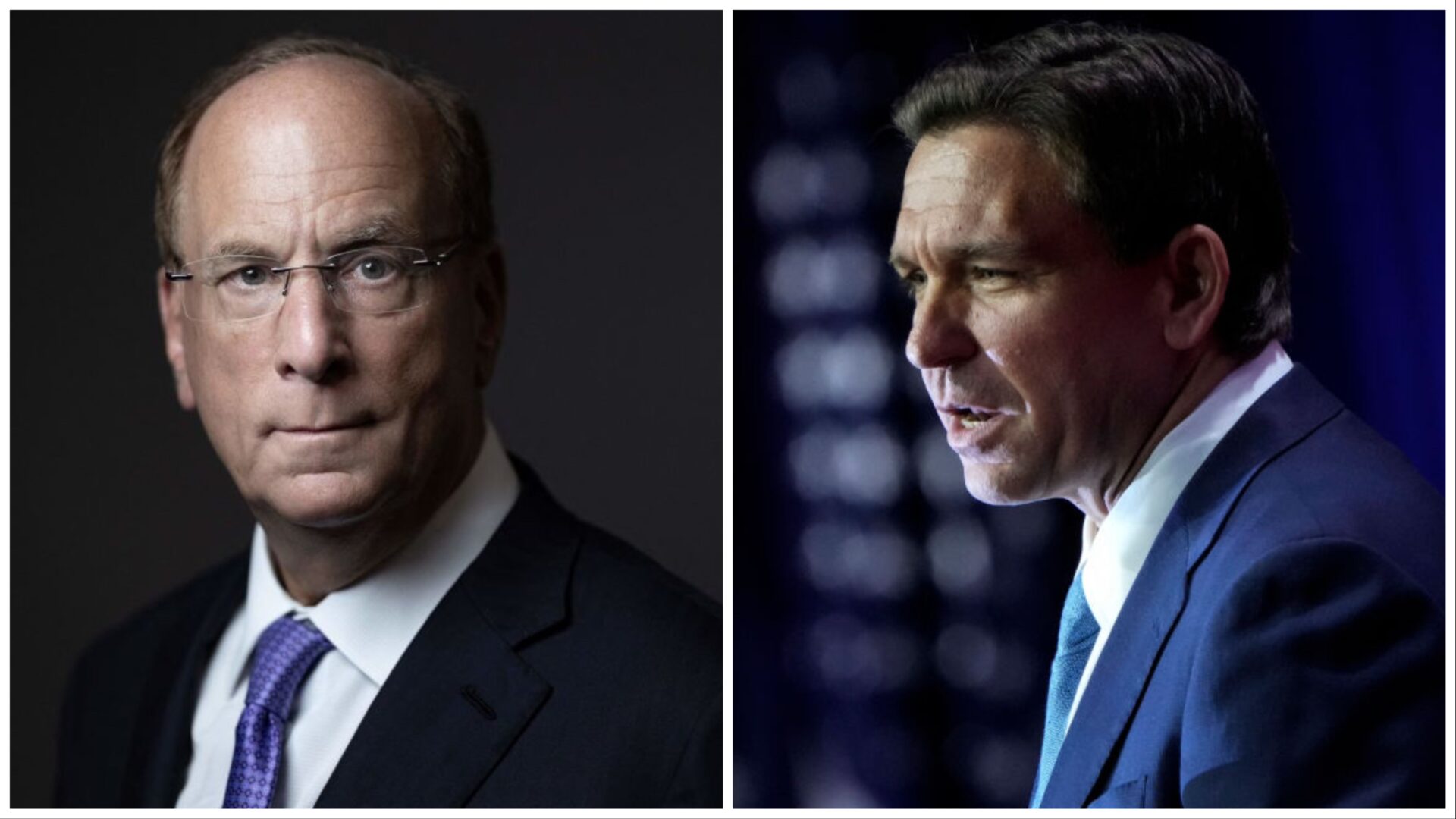

BlackRock CEO Larry Fink, whose company’s woke positions have alienated conservative states across the U.S., reportedly admitted that Florida GOP governor Ron DeSantis did damage to his firm when DeSantis pulled $2 billion in assets managed by BlackRock from the firm in 2022.

“In a conversation at the Aspen Ideas Festival on Sunday, Fink acknowledged that Florida Gov. Ron DeSantis’ decision to pull $2 billion in assets hurt his firm in 2022,” Axios reported Sunday.

In early December 2022, Florida Chief Financial Officer Jimmy Patronis announced the pullback from BlackRock. The previous August, DeSantis joined the other trustees of Florida’s Board of Administration (SBA) to pass a resolution directing the state of Florida’s fund managers to invest state funds without considering the ideological agenda of the environmental, social, and corporate governance (ESG) movement.

“The tax dollars and proxy votes of the people of Florida will no longer be commandeered by Wall Street financial firms and used to implement policies through the board room that Floridians reject at the ballot box,” DeSantis stated. “We are reasserting the authority of republican governance over corporate dominance and we are prioritizing the financial security of the people of Florida over whimsical notions of a utopian tomorrow.”

BlackRock attacked DeSantis and his state in a statement saying, “As a fiduciary, everything we do is with the sole goal of driving returns for our clients. … We are disturbed by the emerging trend of political initiatives like this that sacrifice access to high-quality investments and thereby jeopardize returns, which will ultimately hurt Florida’s citizens.”

South Carolina, Louisiana, and Missouri also pulled funds from BlackRock in 2022. Louisiana State Treasurer John Schroder said, “In my opinion, your support of ESG investing is inconsistent with the best economic interests and values of Louisiana. I cannot support an institution that would deny our state the benefit of one of its most robust assets. Simply put, we cannot be party to the crippling of our own economy.”

Axios reported that Fink said he would not use the term “ESG” (environmental, social, and governance) in the future because it was being politically “weaponized.” Fink added, “I’m ashamed of being part of this conversation. When I write these [investment] letters, it was never meant to be a political statement. … They were written to identify long-term issues to our long-term investors.”

But when Axios pressed him on the issue, Fink reportedly reversed himself, declaring, “I never said I was ashamed. I’m not ashamed. I do believe in conscientious capitalism.”

In October 2022, BlackRock was downgraded by UBS analyst Brennan Hawken, which slashed the target stock price from $700 to $585, according to a report from Barron’s. “We are downgrading BLK to Neutral based on environmental pressure to earnings and risk from the firm’s ESG positioning,” Hawken stated.